Is not something to be proud of when you are not eligible to pay taxes right? You should be proud when you can pay tax and Zakat. It shows how well is your income and how well you managed it. But many feel greedy when it comes to it.

Hence, why do netizens have to pay LHDN Tax?

The Inland Revenue Board of Malaysia (LHDNM-Lembaga Hasil Dalam Negeri Malaysia) is one of the main agencies below The Ministry of Finance is responsible for collecting and administering the country's direct taxes. IRBM was established under the Malaysian Inland Revenue Board Act 1995.

Formerly known as the Inland Revenue Department of Malaysia (JHDNM), it was incorporated on 1st March 1996 and is known as the Inland Revenue Board of Malaysia (LHDNM).

This agency is responsible for the entire administration of direct taxes under the following acts:

- Income Tax Act 1967

- Petroleum (Income Tax) Act 1967

- Real Estate Gains Tax Act 1976

- Investment Promotion Act 1986

- Stamp Act 1949

- Labuan Business Activity Tax Act 1990

* UPDATED ON 11/01/2023

Why Pay Taxes?

The revenue from this tax is used by the government to administer and manage a country and also to be used for development expenses. The government allocates the collected taxes to be spent for the purpose of national and people's security, physical development, and infrastructure such as roads, hospitals, and schools as well as economic and social development such as health services, education, and people's welfare.

1. Community Welfare

Did you know, society's welfare and safety can be improved if you all pay taxes without evasion. This can be seen when the B40 group and the homeless are the ones who receive the most benefits from taxes. For example, it is like giving cash which is Bantuan Keluarga Malaysia (BKM) and Bantuan Penjana for that group.Revenue from taxes is also used to build infrastructure facilities such as hospitals, schools, and public transport. When the welfare of the people is maintained, then the crime rate will gradually decrease. The revenue from this tax is also capable of bridging the gap between the elite and normal citizens.

2. For the sake of the National Economy

No country in the world can survive without taxes. There may be some countries that do not practice certain taxes such as GST/VAT but still have other taxes. Taxes also help the government a lot to implement various policies whether it is for the people or not only. In fact, it also helps the national economy to run and be competitive.

Once upon a time there was a debate about why we need to pay taxes when Malaysia has a lot of oil reserves. Just use the revenue from the oil to become rich like the Middle Eastern countries.

Today we see the price of oil falling more and more with the coronavirus, most of the countries in the Middle East are calm because they are too dependent on oil. Our own country is almost dying when the percentage of dependence on oil is increasing when the GST tax is eliminated. So paying taxes is one of our functions to the country for the welfare of the people.

3. Avoid Having to Pay Lumpsum

Few of us will definitely think of tactics to reduce tax payments to the government. In fact, there are those who continue to try to avoid paying it even though their income exceeds the number to pay tax. So pay taxes as desired and keep in mind that it is for the benefit of society.You can just not pay tax but you have to be willing to accept the risk of being sued and having to pay lumpsum.

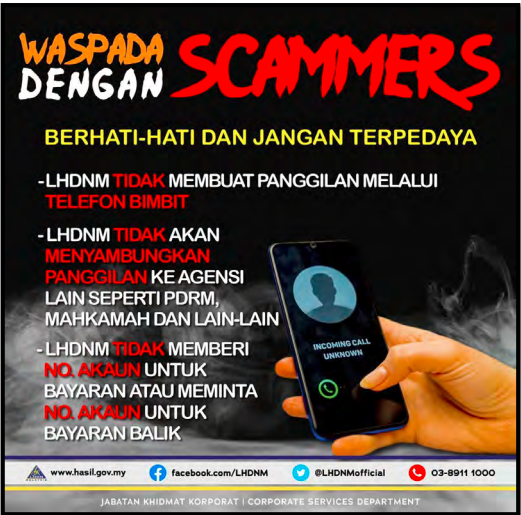

Beware of LHDN Scammers.

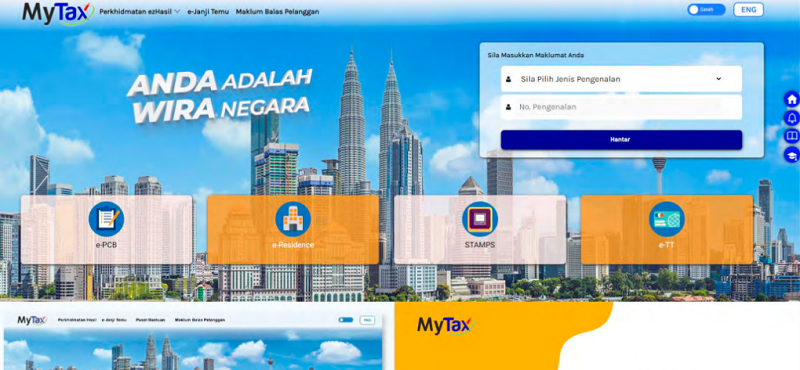

Anyway guys, please take note LHDN does call the taxpayer but they don't ask you to pay them at a personal account. Everything will only go to the main account and to be safe do use the MyTax apps or website.

What to do if you received call or email from 'LHDN'?

1. Check with Lembaga Hasil Dalam Negeri Malaysia :

• Call to Hasil Care Line at 03-8911 1000 / 03-8911 1100 (Overseas)

• HASiL Live Chat

• IRBM Feedback Form on the IRBM official portal

• Attend the nearest Branch

2. Do not disclose banking details especially internet banking passwords.

3. Do not click on links received from dubious emails.

4. Make sure tax arrears are paid only to IRBM.

5. Do not download any application requested by unknown callers.

6. Check the Tax Collection Framework, Tax Audit Framework and Tax Investigation Framework on the portal IRB official at www.hasil.gov.my > Legislation to confirm the valid procedure of collection activities, IRB tax audit and investigation.

7. Make sure the IRBM's official email is domain@hasil.gov.my

If you are still curious and furious, just hang up. It is much safer than being a victim, right? hihi

Anyway, I hope everyone finds the reason why we should pay taxes. To summarize, the tax is for us too, or maybe our children, sister, cousin, or neighbor. Hence, paying taxes will make Malaysia more progressive and safe. InshaAllah.

#HasilxInfluencer

Thank you for dropping by. All comments are fully your responsibility.

Any comments are subjected to the Act 588 MCMC 1988. Comment wisely, and do it with open heart!

Happy Blogging.

For any inquiries, email : shamiera_osment@yahoo.com